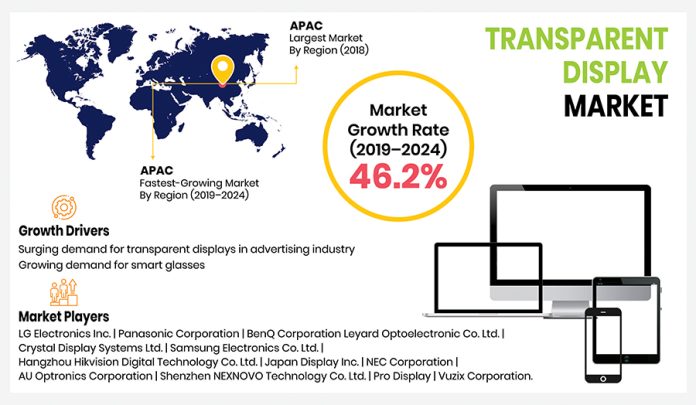

Factors such as escalating demand for smart glasses and growing adoption of transparent displays in the advertising industry will accelerate the transparent display market at 46.2% CAGR during the forecast period (2019–2024). The market stood at $524.7 million in 2018 and it is set to value $4,933.6 million in 2024. The market is currently observing high adoption of transparent organic light-emitting diode (OLED) displays, as these are more beneficial than liquid crystal display (LCD) displays, due to the fact that they offer better viewing angles and higher image resolution than the latter.

One of the most significant growth drivers is the widescale installation of transparent displays for outdoor advertisements, because they amplify the aesthetic appeal of the advertisements. Businesses are setting up these displays to promote their products through digital signage. The increasing popularity of digital signage can be ascribed to the expansion of the out-of-home (OOH) advertisement industry, which thrives on the development of improved technology-based retail stores. Additionally, the mounting competition among retail companies has led to the widescale incorporation of these displays for advertising purposes.

Access Report Summary – Transparent Display Market Segmentation Analysis Report

Moreover, the intensifying advancements in the healthcare sector will fuel the transparent display market in the forecast period. Healthcare facilities are using these products during surgical procedures and checkup of patients. These screens display vital sign of patients, such as blood pressure, oxygen levels, and heartbeats, which assist doctors during regular checkups and surgeons during critical operations. Moreover, the growing healthcare spending across the world will boost the demand for these products in the future.

The application segment of the transparent display market is categorized into digital signage, heads-up displays, smart appliance, and head mounted display (HMD). Among these, the digital signage accounted for the largest market share in 2019, due to the burgeoning application of transparent displays in the education, healthcare, retail, and transportation sectors. Whereas, the HUD category is expected to exhibit the highest CAGR during the forecast period, owing to its widening application base in the aerospace and defense and automobile sectors. The automotive industry uses these screens to display the direction and speed to reduce the incidence of road accidents.

How Does Advertising Sector Boost Transparent Display Market Growth?

During the forecast period, the transparent display market will demonstrate the fastest growth in Asia-Pacific (APAC), due to the burgeoning demand for these products from Japan, India, South Korea, and China. Moreover, the presence of numerous transparent display manufacturers in China will make it the leading nation in the region. Besides, low cost of these displays, their increasing adoption in the retail sector, and rising number of shopping malls and shopping complexes will propel the demand for transparent displays in the country during the forecast period.

On the other hand, North America is expected to make notable contribution to the transparent display market in the coming years. This can be attributed to the hefty research and development (R&D) spending on innovations and technology developments. Like the APAC region, the retail sector of North America will emerge as the largest consumer for these products throughout the forecast period. In the retail industry, shopping complexes will install the highest number of such displays to improve their daily operations.

Thus, the growing focus of retail sectors on outdoor advertisements and the increasing application of transparent displays in the healthcare industry will fuel the market in the forecast years.

Why will Transparent Display Market Boom in North America and Asia-Pacific in Future?

The global transparent display market value stood at $524.7 million in 2018, and it is expected to surge to $4,933.6 million by 2024. According to the estimates of the market research company, P&S Intelligence, the market will demonstrate a CAGR of 46.2% from 2019 to 2024 (forecast period). The soaring requirement for transparent displays in the advertising sector and the burgeoning need for smart glass are the major factors fueling the expansion of the market across the world.

The transparent display market is witnessing a massive rise in the requirement for transparent displays for various outdoor advertisement applications, as these displays improve the aesthetic appeal of advertisements. Businesses are rapidly adopting transparent displays for promoting their products via digital signage. The increasing transparent digital signage popularity can be credited to the booming out-of-home (OOH) advertisement industry, which is being driven by the emergence of advanced technology-based retail outlets.

Transparent Display Market Segmentation Analysis Report

In addition, the overall expenditure in the advertisement industry is surging sharply, because of the growing competition among the players operating in the retail industry. This is subsequently pushing up the requirement for transparent displays, that display information regarding services, offers, discounts, and products in a highly aesthetic way. Besides, the rapid technological advancements being made in the healthcare sector are also creating lucrative growth opportunities for the players operating in the transparent display market.

This is because these displays are being increasingly required in applications, such as patient checkup and surgery. Additionally, these displays are also being adopted for assisting surgeons during critical procedures, as they display the vital signs of patients, such as blood pressure, oxygen levels, and heartbeats. Depending on application, the transparent display market is divided into digital signage, smart appliance, head mounted display (HMD), and heads up display (HUD) categories. Out of these, the digital signage category contributed the highest revenue to the market in the past.

Structural Analysis of Transparent Display Market

This was because of the surging adoption of digital signage by end users, such as transportation, retail, education, and healthcare industries. Moreover, the retail sector is currently the largest procurer of transparent digital signage. The transparent display market is expected to boom in the Asia-Pacific (APAC) and North American regions in the coming years, mainly because of the soaring research and development (R&D) expenditure on technology innovation and development. The total R&D expenditure on technology innovation and development in the U.S. surged to $553 billion in 2018 from $538 billion in 2017.

The APAC region is expected to be the fastest-growing region in the market throughout the forecast period. This will be because of the ballooning requirement for transparent displays in developing nations, such as Japan, India, and China. China dominated the regional market in 2018, because of the presence of a large number of local transparent display manufacturing companies in the country. These companies are manufacturing these displays at lower prices, thereby facilitating the expansion of the market in the country.

Hence, the market will grow substantially in the coming years, mainly because of the rising demand for transparent displays in the advertising sector.

Chapter 1. Research Background

1.1 Research Objectives

1.2 Market Definition

1.3 Research Scope

1.3.1 Market Segmentation by Technology

1.3.2 Market Segmentation by Application

1.3.3 Market Segmentation by Display Size

1.3.4 Market Segmentation by Resolution

1.3.5 Market Segmentation by End User

1.3.6 Market Segmentation by Geography

1.3.7 Analysis Period

1.3.8 Market Data Reporting Unit

1.3.8.1 Value

1.3.8.2 Volume

1.4 Key Stakeholders

Chapter 2. Research Methodology

2.1 Secondary Research

2.2 Primary Research

2.2.1 Breakdown of Primary Research Respondents

2.2.1.1 By region

2.2.1.2 By industry participant

2.2.1.3 By company type

2.3 Market Size Estimation

2.4 Data Triangulation

2.5 Assumptions for the Study

Chapter 3. Executive Summary

Chapter 4. Introduction

4.1 Definition of Market Segments

4.1.1 By Technology

4.1.1.1 LCD

4.1.1.2 OLED

4.1.1.3 Others

4.1.2 By Application

4.1.2.1 HMD

4.1.2.2 HUD

4.1.2.3 Smart appliance

4.1.2.4 Digital signage

4.1.3 By Display Size

4.1.3.1 Small

4.1.3.2 Medium

4.1.3.3 Large

4.1.4 By Resolution

4.1.4.1 HD

4.1.4.2 Full HD

4.1.4.3 UHD

4.1.4.4 Others

4.1.5 By End User

4.1.5.1 Industrial

4.1.5.2 Retail and hospitality

4.1.5.3 Automotive

4.1.5.4 Aerospace and defense

4.1.5.5 Transportation

4.1.5.6 Healthcare

4.1.5.7 Sports and entertainment

4.1.5.8 Others

4.2 Value Chain Analysis

4.3 Market Dynamics

4.3.1 Trends

4.3.1.1 Growing use of OLEDs

4.3.1.2 Increasing adoption of interactive transparent displays

4.3.2 Drivers

4.3.2.1 Surging demand for transparent displays in advertising industry

4.3.2.2 Growing demand for smart glasses

4.3.2.3 Impact analysis of drivers on market forecast

4.3.3 Restraints

4.3.3.1 High cost of transparent displays as compared to traditional devices

4.3.3.2 Impact analysis of restraints on market forecast

4.3.4 Opportunities

4.3.4.1 Decreasing prices of transparent displays

4.3.4.2 Increasing use of transparent displays in healthcare industry

4.4 Porter’s Five Forces Analysis

Chapter 5. Global Market Size and Forecast

5.1 By Technology

5.2 By Application

5.3 By Display Size

5.4 By Resolution

5.5 By End User

5.6 By Region

Chapter 6. North America Market Size and Forecast

6.1 By Technology

6.2 By Application

6.3 By Display Size

6.4 By Resolution

6.5 By End User

6.6 By Country

Chapter 7. Europe Market Size and Forecast

7.1 By Technology

7.2 By Application

7.3 By Display Size

7.4 By Resolution

7.5 By End User

7.6 By Country

Chapter 8. APAC Market Size and Forecast

8.1 By Technology

8.2 By Application

8.3 By Display Size

8.4 By Resolution

8.5 By End User

8.6 By Country

Chapter 9. LATAM Market Size and Forecast

9.1 By Technology

9.2 By Application

9.3 By Display Size

9.4 By Resolution

9.5 By End User

9.6 By Country

Chapter 10. MEA Market Size and Forecast

10.1 By Technology

10.2 By Application

10.3 By Display Size

10.4 By Resolution

10.5 By End User

10.6 By Country

Chapter 11. Competitive Landscape

11.1 List of Key Players and their Offerings

11.2 Ranking of Key Players

11.3 Competitive Benchmarking of Key Players

11.4 Recent Activity of Key Players

11.5 Strategic Developments of Key Players

11.5.1 Product Launches

11.5.2 Facility Expansions

11.5.3 Client Wins

11.5.4 Other Developments

Chapter 12. Company Profiles

12.1 LG Electronics Inc.

12.1.1 Business Overview

12.1.2 Product and Service Offerings

12.1.3 Key Financial Summary

12.2 Panasonic Corporation

12.2.1 Business Overview

12.2.2 Product and Service Offerings

12.2.3 Key Financial Summary

12.3 Samsung Electronics Co. Ltd.

12.3.1 Business Overview

12.3.2 Product and Service Offerings

12.3.3 Key Financial Summary

12.4 Hangzhou Hikvision Digital Technology Co. Ltd.

12.4.1 Business Overview

12.4.2 Product and Service Offerings

12.4.3 Key Financial Summary

12.5 Japan Display Inc.

12.5.1 Business Overview

12.5.2 Product and Service Offerings

12.5.3 Key Financial Summary

12.6 NEC Corporation

12.6.1 Business Overview

12.6.2 Product and Service Offerings

12.6.3 Key Financial Summary

12.7 BenQ Corporation

12.7.1 Business Overview

12.7.2 Product and Service Offerings

12.8 Leyard Optoelectronic Co. Ltd.

12.8.1 Business Overview

12.8.2 Product and Service Offerings

12.9 Crystal Display Systems Ltd.

12.9.1 Business Overview

12.9.2 Product and Service Offerings

12.10 AU Optronics Corporation

12.10.1 Business Overview

12.10.2 Product and Service Offerings

12.10.3 Key Financial Summary

12.11 Shenzhen NEXNOVO Technology Co. Ltd.

12.11.1 Business Overview

12.11.2 Product and Service Offerings

12.12 Pro Display

12.12.1 Business Overview

12.12.2 Product and Service Offerings

12.13 Vuzix Corporation

12.13.1 Business Overview

12.13.2 Product and Service Offerings

12.13.3 Key Financial Summary

Chapter 13. Appendix

13.1 Abbreviations

13.2 Sources and References

13.3 Related Reports